Understand the market

using

Market Profile, Volume Profile & Delta charts

in Amibroker

Empower yourself and shorten your learning curve

Free for 3 days

Rs. 699 for 30 days

using

in Amibroker

Empower yourself and shorten your learning curve

Free for 3 days

Rs. 699 for 30 days

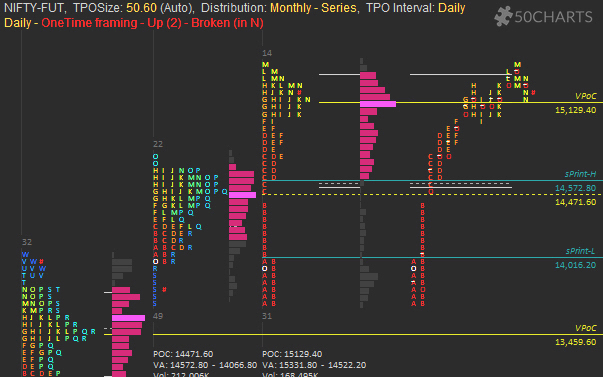

Use Monthly / Quarterly / Yearly profiles to understand the strength of long-term players. Weekly profiles will guide you to identify different Price and Volume zones. Look for entry opportunities in the Daily profile based on the market understanding. Combine any number of profiles to find the strength of buyers / sellers, inside the trading range. The expiry day can be configured to view different Weekly / Monthly expiry series.

Try it Free

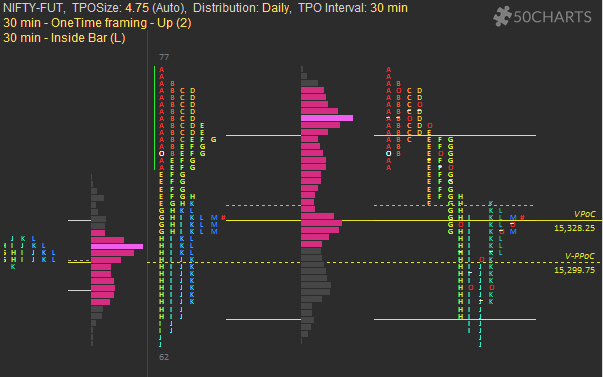

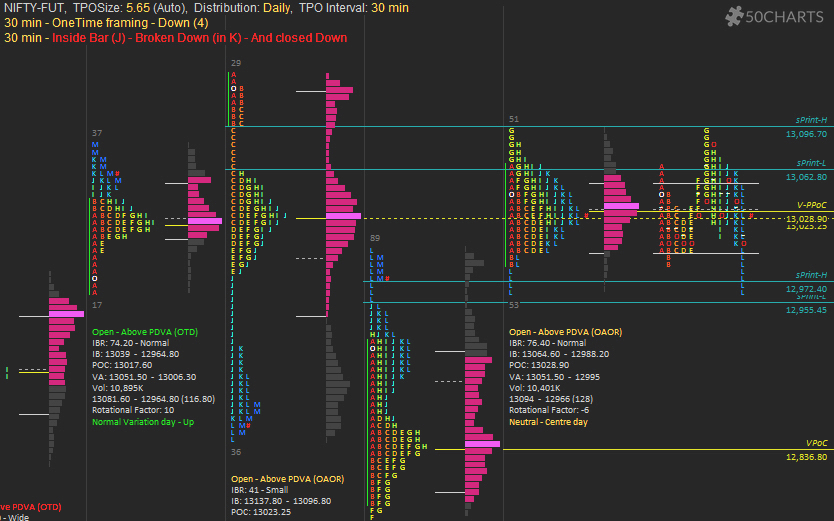

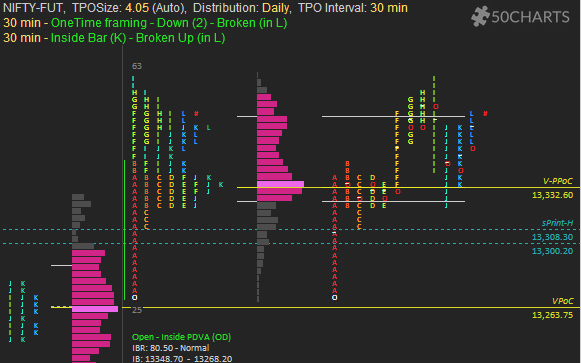

Value Area High / Low, Point of Control (PoC) and Initial Balance, acts as a reference to understand the current Market Auction. Half back references are Intraday references to identify weak players. Other reference lines help to monitor the market behaviour at those levels.

Try it Free

Virgin PoC (vPoC), Virgin Prominent PoC (vPPoC), Single Print, and High Volume Nodes (HVNs) in Volume distribution, helps to identify next possible Support / Resistance.

Try it Free

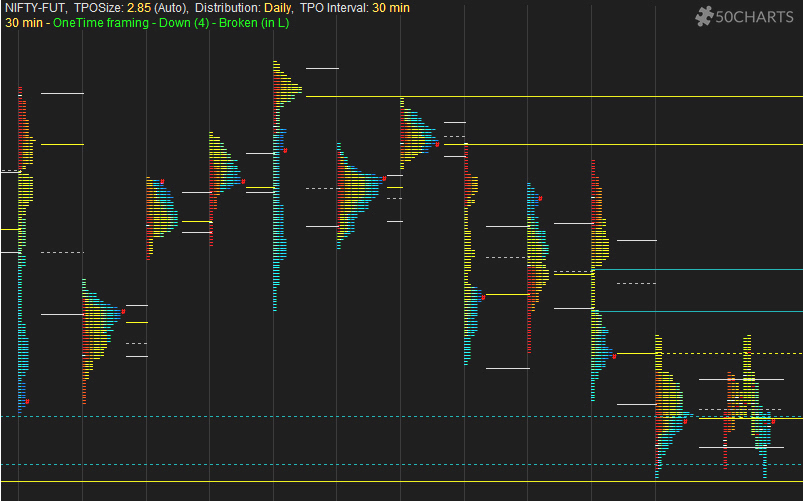

One Time framing helps to identify who is in control. Inside bars and outside bars helps to understand whether the market is in Balance or trying to move out of Balance. Any change in Status Quo, will be highlighted to take quicker decisions.

Try it Free

The importance of TPO Size, is to approximate the absolute price movements and visualize the Profile. We take care of automatically calulating the TPO Size based on the selected stock price and the available visible space. With just a mouse drag, the TPO Size gets updated in real time.

Try it Free

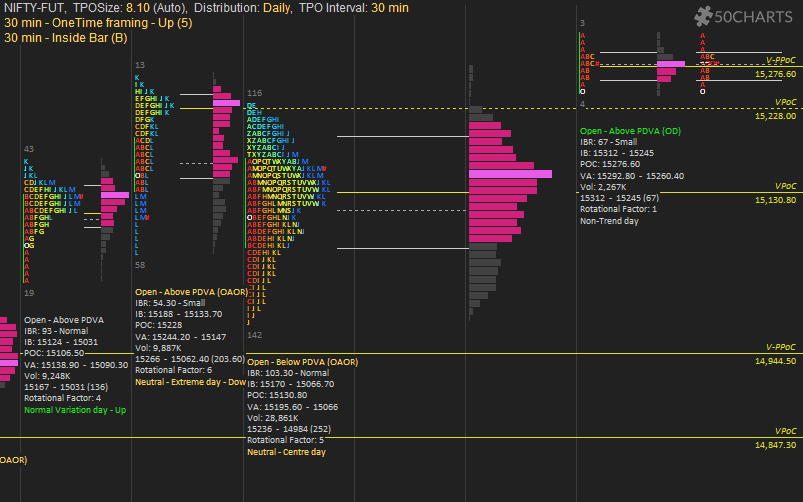

Summary provides minute details of the profile like Open Type, Day Type, IB range, Volume MA, etc. Rotational Factor, TPO count helps to understand rotational days. Higher volumes are highlighted to quickly grab attention.

Try it Free

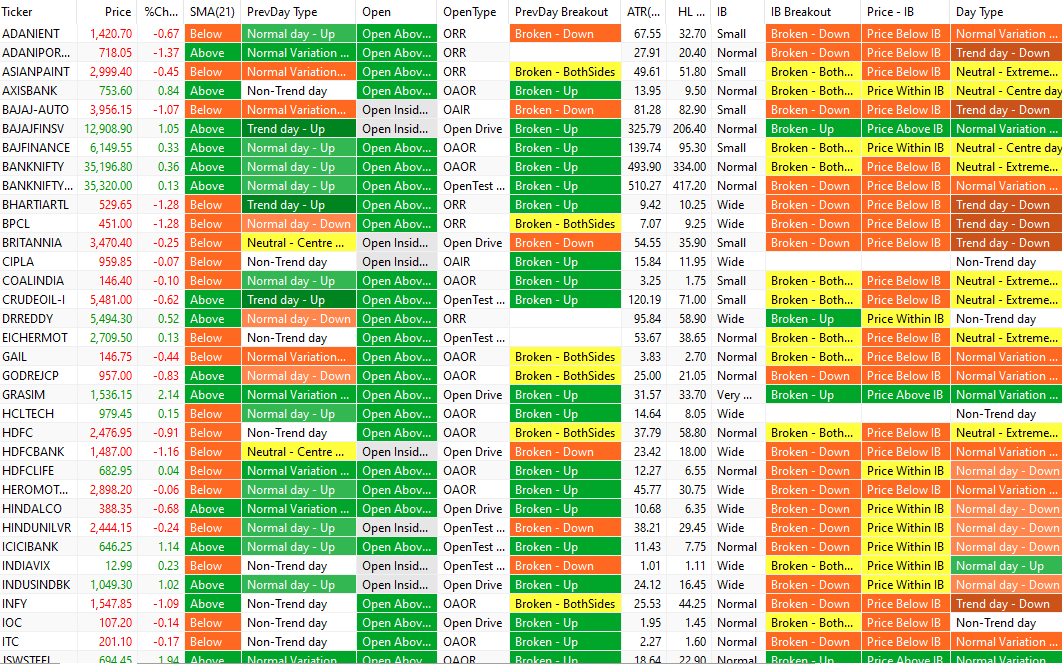

Scanner helps to shortlist the stocks using IB range, Open=High/Low, Prev Day high / low breakouts, Open based on Yesterday's Value Area, Open type after the IB is formed, Day Type, Single Print, etc.

Try it Free

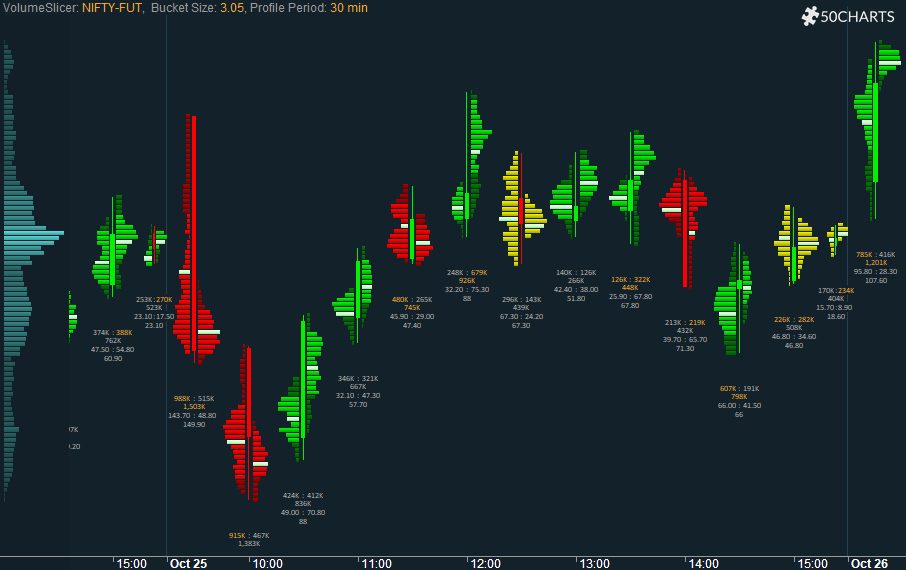

Volume sliced by Time & Price, in timeframes - 15min, 30min, 60min, 75min, Daily, Weekly & Monthly. It also highlights Value Area, VWAP, color coded profile based on VWAP of first and second half of the candle. Volume Slicer chart works with Tick level accuracy.

Try it Free

Delta chart includes Delta, Max Delta, Min Delta, Cummulative Delta, Buy - Sell Volume charts. Tick data is used to calculate these values using Up/Down Tick method. Visual representation of these values provides an additional edge for the traders.

Try it Free

No hefty-upfront Investment. Subscribe every Month until you are confident.

Amibroker is one of the fastest charting tool. Make use of it's power, to try Market Profile charts.

We believe in Incremental change. More features will be added Continuously.

No Extra Charges for Upgrades. Always be up-to-date with the latest features.

*Before downloading, check the System requirements given below

for 32-bit Amibroker

for 64-bit Amibroker

✓ Free for first 3 days - Includes all charts and MP scanner. No Sign Up required. Check How to Install video

Rs. 17999

(per month approx.)

(for 365 days)

(per month approx.)

(for 90 days)

(for 30 days)

* To get System ID, Check How to Pay video

New to 50Charts / Amibroker

New to 50Charts / Amibroker

New to 50Charts / Amibroker

New to 50Charts / Amibroker

New to 50Charts / Amibroker

New to 50Charts / Amibroker

New to 50Charts / Amibroker

New to 50Charts / Amibroker

New to 50Charts / Amibroker

Pay / Subscribe

Pay / Subscribe

Pay / Subscribe

Pay / Subscribe

Pay / Subscribe

Pay / Subscribe

Pay / Subscribe

Pay / Subscribe

Learning

Learning

Charts

Charts

Charts

Charts

Scanner

Scanner

Scanner

Error - Charts

Error - Charts

Error - Charts

Error - Charts

Error - Charts

Error - Charts

Error - Charts

Error - Charts

Update - New Version

Update - New Version

Update - New Version

Update - New Version

Upcoming release(s)

Contact - Support

Contact - Support